Hourly rate of pay means the daily or ordinary rate of pay divided by the normal hours of work as agreed between the employers and employees. How to Perform Salary Calculator Malaysia.

Your Step By Step Correct Guide To Calculating Overtime Pay

For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955.

. In one working day employees can work up to 8 hours if it is a six-day workweek. Salary Formula as follows. Overtime on Normal Working Day.

The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay. In excess of eight 8 hours-. For a given week track the amount of time your employee worked.

The amendments codify that Pennsylvania employers cannot use the fluctuating workweek. Then multiply their pay rate by 15 time and a half. For employees whose salary exceed RM2000 a month the hours of work and overtime work depend on the terms agreed under their employment contracts.

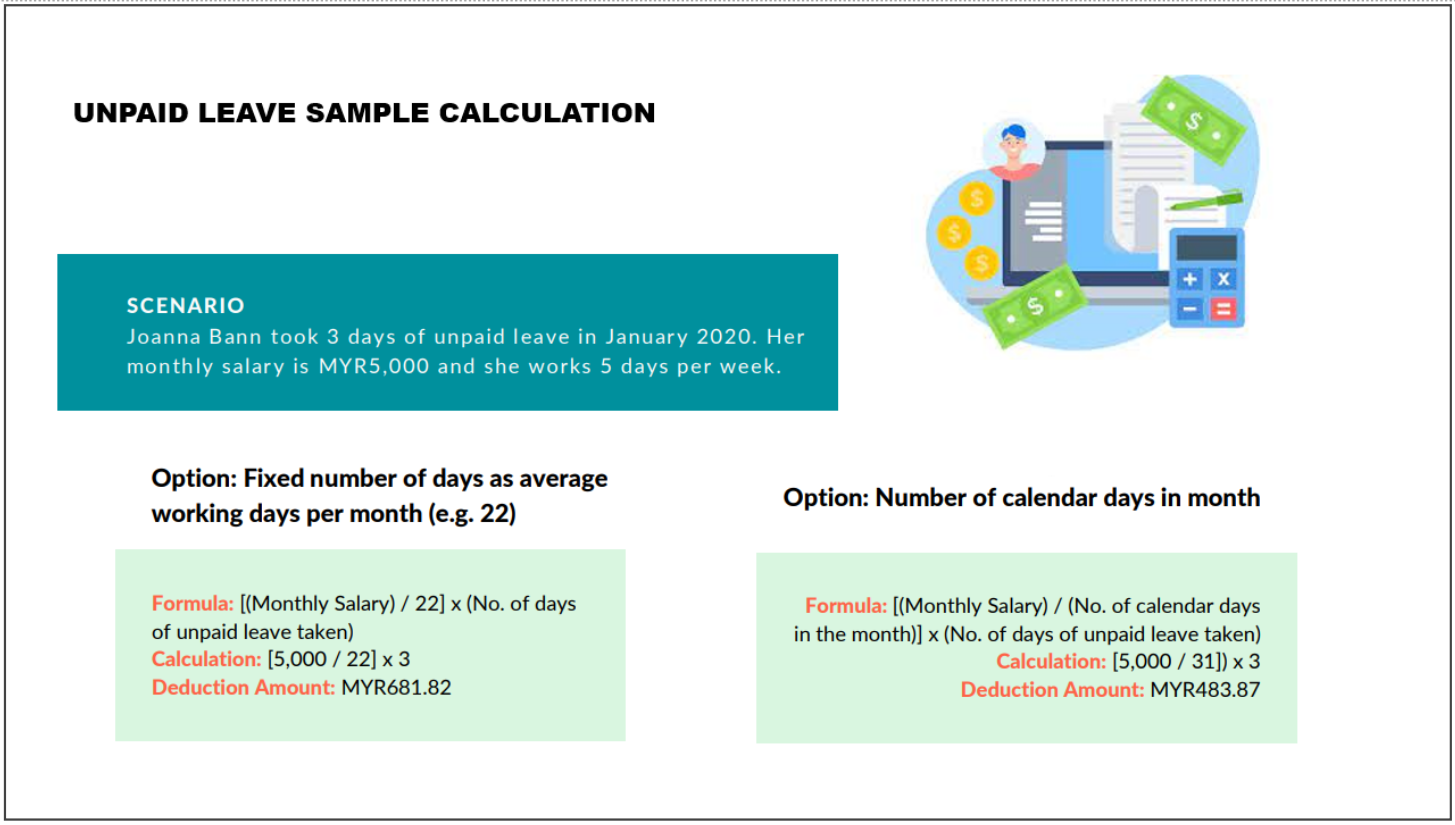

Shall not be construed as overtime work for the purposes of calculating 104 hours of overtime in any one month. Malaysia Daily Salary After Tax Calculator 2022. The overtime pay calculation is simple.

Add 8 hours to make up the 2 days wages. An employee weekly rate of pay is 6. Not exceeding half his normal hours of work-05 x ordinary rate of pay half-days pay ii.

When an employee receives a monthly rate of pay the ordinary rate of pay should calculate accordingly. Find out how many hours they worked over 40. Of course overtime work has a limit.

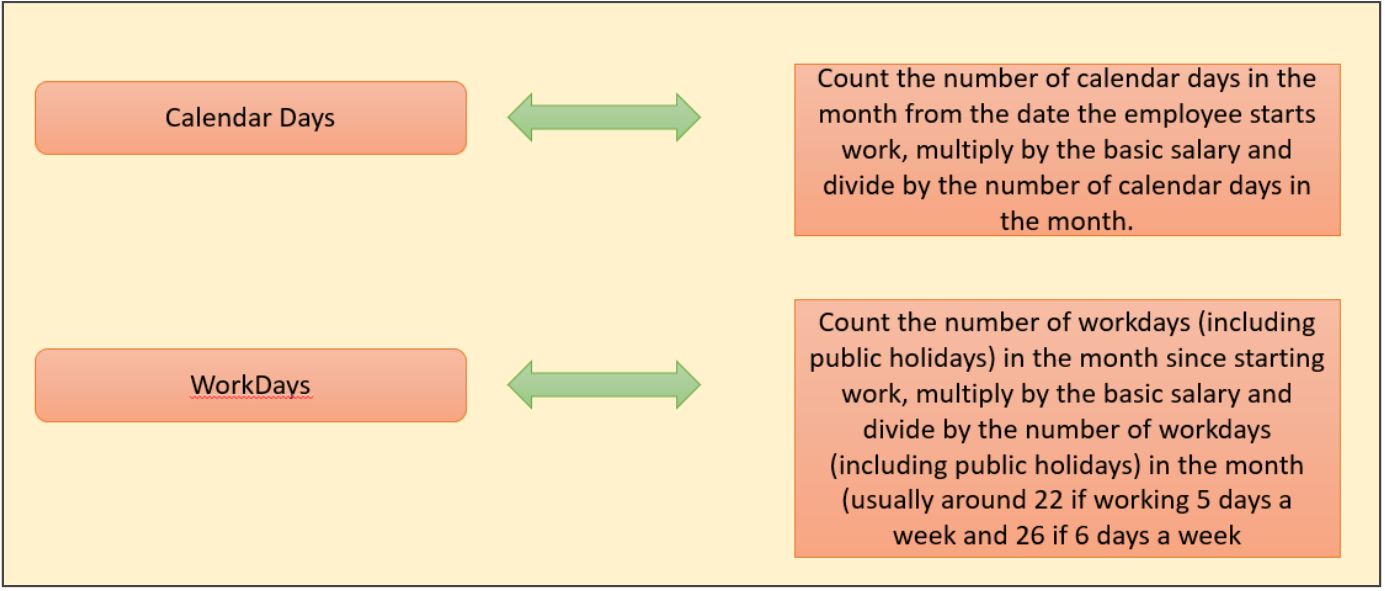

The overtime rate shall be 15 x Hourly Rate x Number of Hours Worked b. Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. Monthly rate of pay No.

The monthly wage calculator is updated with the latest income tax rates in malaysia for 2022 and is a great calculator for working out your. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. RM6250 3 RM18750.

Determine your usual rate of compensation by dividing your paycheck by the number of hours you worked. If it is a five-day workweek employees can work a maximum of nine. Calculate overtime compensation by multiplying the number of hours worked over and above the usual rate of pay by one-half the regular rate of pay.

Overtime Rest-day x2 as the employee is already receiving his normal holiday pay through his monthly salary so only the additional x2 rate needs to be added. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. Compute your ordinary rate of pay or daily rate.

The calculation of overtime in Malaysia is rather simple than the working and non-working days. Basic Allowance Incentive 26 days 8 hours. No employee shall be entitled to paid sick.

Of work days in the relevant month So when an employee works 8 hours a day for a monthly salary of RM2600 heshe will have an ordinary rate of pay of RM100 Monthly salary 26 RM2600 26 RM100. In PayrollPanda use the preset overtime item. The rules for normal working hours as laid down by the EA 1995 include.

Even though the pay rate is 1 ½ time the hourly rate of employee pay some employers found it rather economical to. Overtime Pay Daily Rate Half Days. There are only two conditions to cater to.

The law on overtime. Calculate your overtime pay. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii.

Pay The employer shall pay the employee his ordinary rate of pay for every day of such sick leave. Pennsylvania employers with salaried nonexempt employees working in the commonwealth may need to adjust how they calculate overtime premiums for these employees in light of amendments to the Pennsylvania Minimum Wage Act that will go into effect on August 5. The Employment Limitation of Overtime Work Regulations 1980 grants that the limit of overtime work shall be a total of 104 hours in any 1 month.

Calculate total compensation by adding overtime hours to the base salary. Overtime pay is also included in the gross pay. Finally multiply this time-and-a-half pay rate by the number of overtime hours they worked.

Overtime hours 3 hours Overtime pay Hourly rate X Overtime hours X Overtime rate RM 8 X 3 X 15 RM 36. Workers can work up to 48 hours per week for a maximum of three weeks. Multiply your hourly rate by the number of overtime hours and overtime rate.

Divide your monthly salary by 26 to get your daily rate. This means an average of 4 hours in 1 day. Overtime Pay Non-Working Days Overtime Hourly Rate Overtime.

Divide the employees daily salary by the number of normal working hours per day. The Labor Law in Malaysia is regulated mainly by the Employment Act of 1955. An employee monthly rate of pay is always fixed to 26.

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

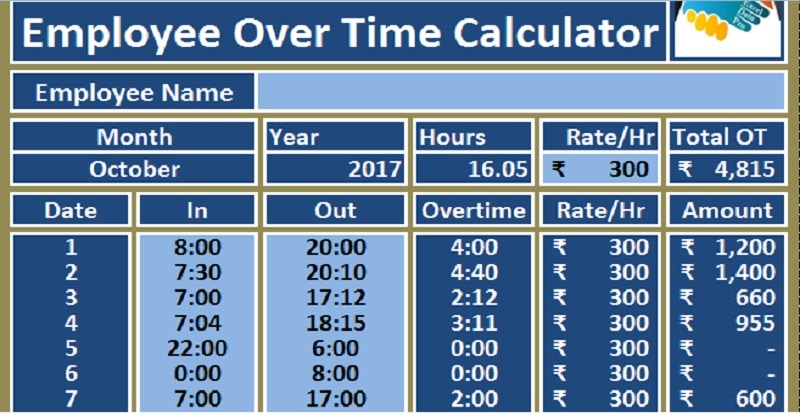

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Download Employee Overtime Calculator Excel Template Exceldatapro

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

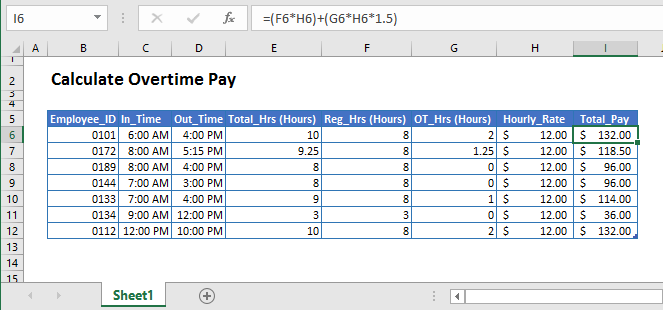

Excel Formula Basic Overtime Calculation Formula

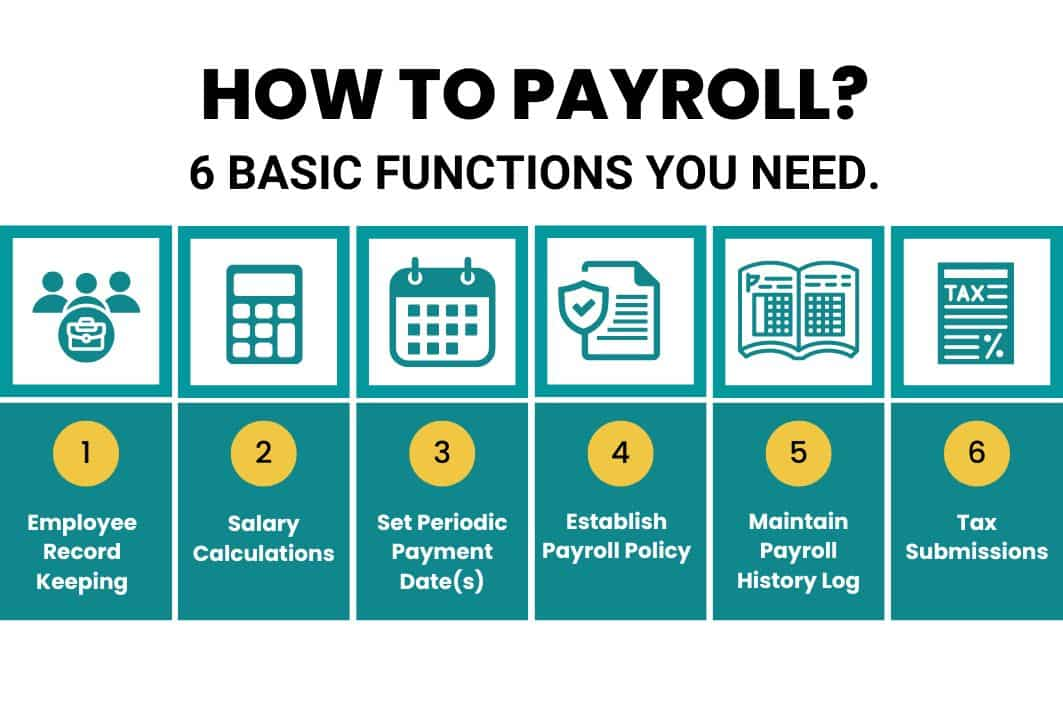

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Excel Timesheet Calculator Template For 2022 Free Download

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Timesheet Calculator Template For 2022 Free Download

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculator For Payroll Malaysia Smart Touch Technology